Often people first encounter an accountant when it becomes clear that the government requires businesses to meet their statutory requirements. We realise that every business operates in a different way and there is no one size fits all solution.

The government has been pressuring businesses to maintain digital accounting records and to file online – “Making Tax Digital”. This will accelerate once Covid is sorted.

We have experience of several different cloud accounting systems and are well placed to help to choose the system that is best suited to your business. We work with all the main providers because different systems suit different people for different reasons. We can help you to set up a system once you have chosen the right one for you and can assist both in maintaining your system and ensuring it contributes to your business and is not just an obligation.

One particular benefit of the move towards making tax digital is that businesses of all shapes and sizes can have access to up to date information on the performance of their business. This means that clients can both satisfy the government requirements and obtain better and more up to date information in order to effectively manage their businesses.

We prepare annual accounts using our specialist software, which can be approved remotely.

We provide support in these areas to clients (though not on a stand-alone basis).

Payrolls for small businesses can be time consuming and easy to get wrong. Once employee numbers approach double figures we usually recommend that clients move on to a payroll bureau.

Registration for the Construction Industry Scheme is often overlooked until too late. CIS is a fruitful source of income for HMRC in the form of penalties. We recommend advice is taken well in advance – whether you are engaging sub-contractors or are a sub-contractor yourself.

The UK tax system is one of the most complex in the world. Every year there is an increase in the volume and complexity of tax law. Mark Buffery is a specialist tax adviser and has over 30 years’ experience in tax matters. He regularly sits in the Tax Tribunal.

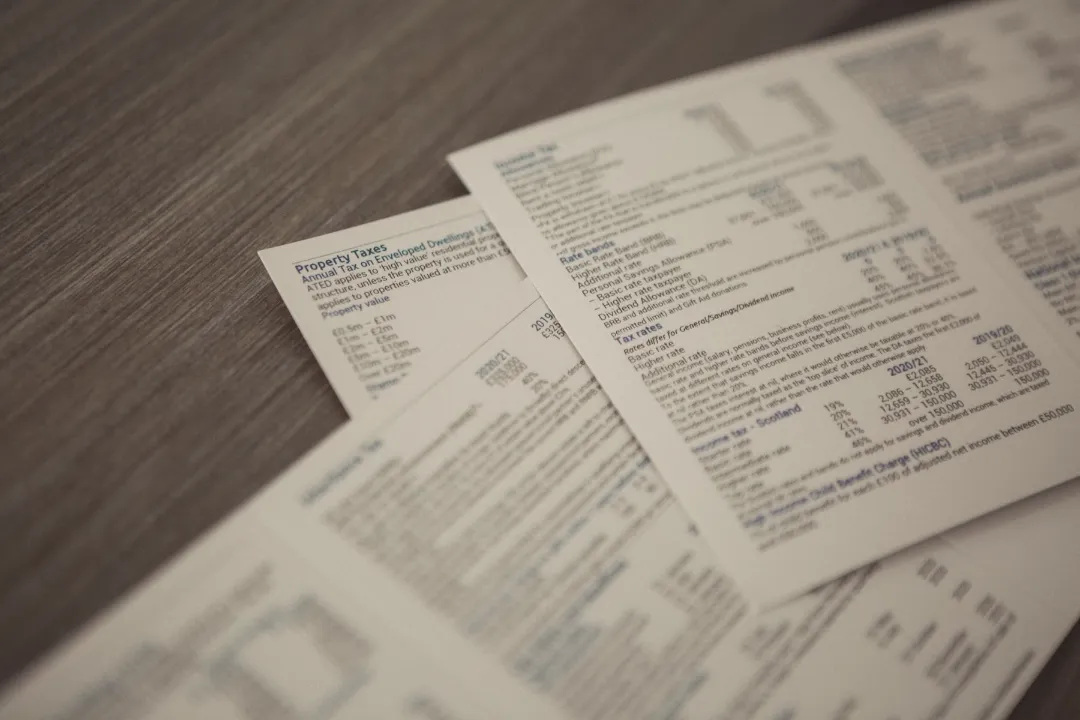

We have the experience and expertise to advise on Income Tax, Corporate Tax, Capital Gains Tax, Inheritance Tax, Property Taxes, Trust Taxes and VAT.

Please note that as tax is so complex it is our policy to confirm in writing any advice on tax provided to our clients.

We frequently obtain authorization from clients to act as agents. This facility allows us to discuss the tax affairs of a client directly with HMRC. As agents, we frequently have dedicated lines of communication with HMRC, thus assisting with resolution of problems and queries.

Contrary to the impressions given by the media, and HMRC, tax planning is legitimate – and always has been. However, it is exactly that – planning. We cannot correct past errors.

There are many entirely legitimate tax breaks, most set up by previous Chancellors which might be avoidable depending on your precise circumstances. If you are looking at a new business venture, purchase or sale of assets, making gifts to family members, indeed anything which may have tax implications, we can assist in advising what options are available and on potential courses of action.

The government is short of money, and HMRC have over recent years taken an increasingly aggressive approach towards the affairs of all taxpayers.

An enquiry can be opened for a variety of reasons. A return can be selected at random, but this is now quite rare. Usually an enquiry is opened because HMRC believe, based on information they have received, that a return may be incorrect.

The process of having an enquiry opened into your affairs is invariably stressful and can be very time consuming. It is all too easy for the taxpayer to unwittingly dig themselves into a hole by trying to be helpful. We have experience in handling most types of dispute with HMRC, and if necessary, can handle an appeal to the First Tier Tax Tribunal. This escalation is rarely required but we do have a large network of contacts in both Law and Accountancy to draw upon should this process be necessary.

We have taken out enquiry insurance which benefits our clients at no extra charge since we started the practice. This is because we recognise that a tax enquiry is expensive and time consuming. Our clients can relax in the knowledge that should an enquiry be opened into their affairs our costs for helping to deal with such an enquiry are usually met by such insurance.

This does not apply to clients where the returns in question (or dispute) were filed by the client or by some other firm or if the returns were either filed late or contained deliberate errors. We hold this policy with Croner Taxwise.

Whether starting a new business venture, looking for an investment, considering the purchase or sale of a business or simply reviewing your current position, we can provide advice and assistance.

Business planning is to put it simply about so much more than merely numbers. A proper business plan helps the client to identify and hopefully achieve their goals. It needs to include a plan of how the business will develop and grow and is almost certain to change over time.

Naturally, we assist with setting up simple tax, accounting and reporting systems so that necessary information is available to fledgling businesses who are often simply too busy keeping plates spinning to look at the bigger picture. We assist with projections ensuring tax compliance is in place and we provide an often-necessary sounding board on a variety of issues such as directors salary, pension planning and tax planning and many other areas.

We can also provide advice and assistance to growing businesses including the formation of companies and Limited Liability Partnerships (LLPs), grouping companies, assistance in gaining outside investment, acting as registered office and provision of company secretarial services.

These tax breaks were introduced by the Government to encourage investment in small business and start-ups. They are invaluable to the companies seeking finance and potential investors alike. HMRC checks claims for these reliefs carefully and the rules are complex. We can advise on how best to ensure that not only the investments qualify for these reliefs, but also ensure that they are not lost at a later time.

Another useful resource for growing businesses. Qualifying options can be a very cost effective method of keeping key staff as the business grows, providing a stake in the business while also enabling the founders to retain control. We assist clients in set up and administration of such schemes.

It is our policy to confirm advice in writing upon which you can rely. Professional written advice is invoiced separately, and clients should expect to have an idea of the likely cost of the advice before it is confirmed in writing.

We assist clients as required with maintaining statutory records. Provided that we also provide other services to the client, we are willing to act as registered office and act as Company Secretary through our nominee company.

This is one of Mark’s favourites! A client will telephone (or email) to ask why a particular relief\payment\saving does not appear to have been claimed on his or her behalf or to ask why they can’t invest in the latest Film Scheme to save tax?

The man in the pub is largely ill informed and his or her information is based on their circumstances which they haven’t necessarily declared to you over a drink!

We would like all our clients to know that collectively we have many years’ experience and we will always act in a professional, legal and above board manner as is required by law and the Institutes of which Mark is a Member . In general, the majority of the schemes or wheezes recommended by the Man or Woman in the pub tend to unravel in a very messy and costly manner!

First things first. If you don’t need an accountant and are capable of doing the work yourself (for example simple tax returns) then we will tell you.

As you’d expect every client or entity is different and their requirements are different. As a broad guide we offer self-assessment tax returns starting at £250 + VAT, but complex tax returns for individuals with multiple sources of income can be considerably higher. Be aware that getting in touch four days before the end of the tax year with a bag full of receipts will attract a penalty charge!

Company Accounts again vary considerably. We have historically invoiced once a year upon completion and filing of the accounts but lately this has been moving towards quarterly billing for clients due to Making Tax Digital. Our intention is that clients should not be billed significantly more over a year than under previous yearly billing. Once we have an idea of the amount and complexity of the likely work we will provide estimates prior to the start of any engagement.

Our staff are at different stages of qualification and therefore more routine tasks can be completed by more junior members of staff to control costs and this is something we routinely do. Be assured that all such work is rigorously reviewed before completion.

We are always happy to have a short introductory meeting (remotely if necessary) whereby you can get a feel for us and see if we can work together. This introductory meeting is free of charge. We think it is important that we are a good fit for each other. After all this is important stuff – your hard-earned salary and your precious businesses – you need to know that you are comfortable dealing with us. Please also be aware that due to Governmental requirements all clients will have to provide two forms of ID. Photo ID and proof of address.

Contact Us